While sustainability resonates across all produce shopper demographics, The Packer’s Sustainability Insights 2025 finds that sustainable packaging might be the most powerful tool grower-packer-shippers and retailers have in engaging sustainability-minded consumers.

Fielded in June 2025, nearly 500 U.S. consumers — who share or do most of their household grocery shopping — completed the Sustainability Insights 2025 survey designed by Prime46 Research and Consulting and Farm Journal’s Intelligence Division.

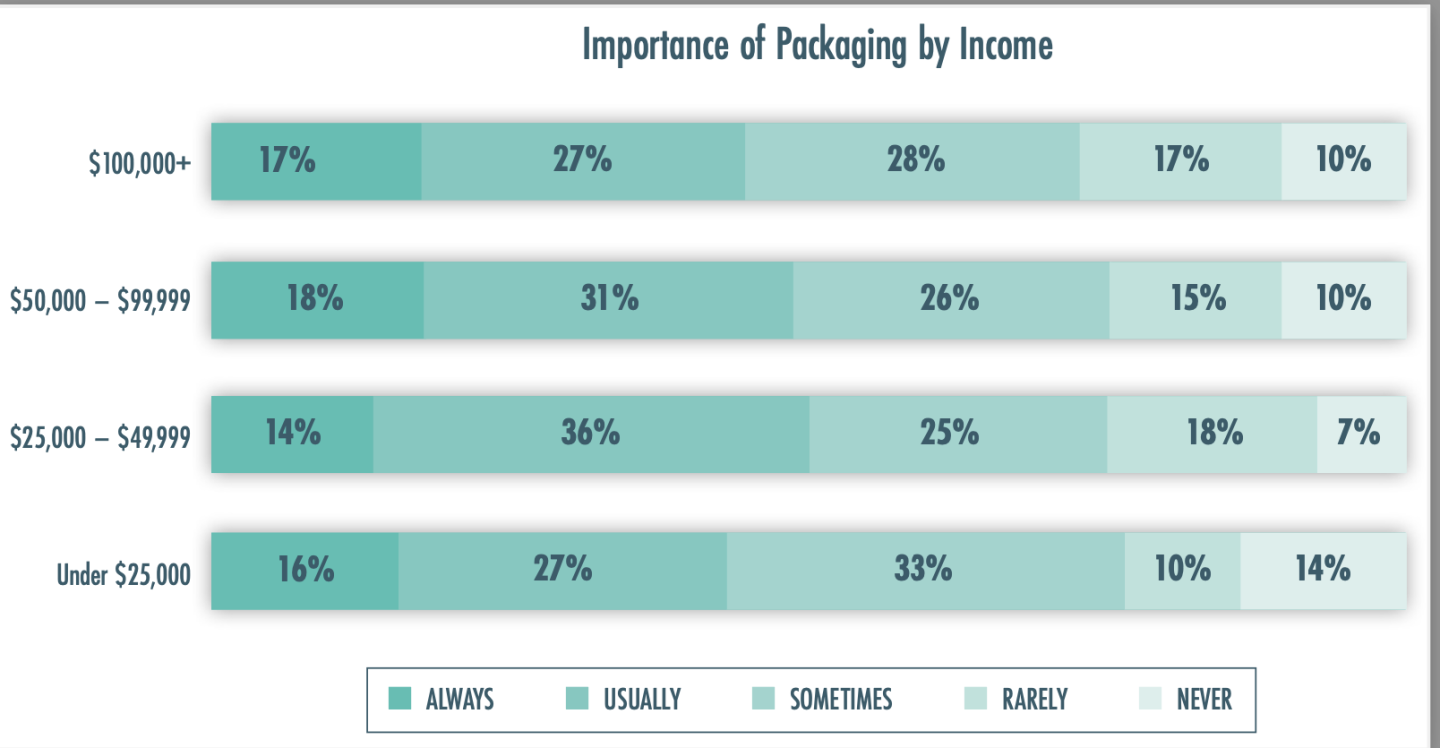

“The most surprising takeaway from the survey was that consumers across all income levels place essentially the same level of importance on packaging materials used as criteria for produce selection,” says Colin Clarke, vice president and director of research for the Fargo, N.D.-based Prime46. “On average, 46.5% of consumers always or usually factor packaging materials in their decision-making.”

“In looking at both ends of the income level spectrum, 43% of consumers under $25,000 in annual household income and 44% of consumers above $100,000 in annual income always or usually factor packaging materials in their decision-making,” he continues. “I anticipated more variance across income levels, but it appears packaging materials used is a factor for all consumers.”

Sustainability Insights 2025 further found that on average 55% of consumers say it is extremely or very important that fresh produce comes in sustainable packaging, and the level of importance increases as the consumer audience gets younger, with 54% of Gen X saying it is extremely or very important, 57% of older millennials, 65% of younger millennials and 68% of Gen Z saying it is extremely or very important.

Growers surveyed in Sustainability Insights 2025 underestimate consumer willingness to pay for sustainable packaging. While 35% of consumers say they will pay upward of 11% more for sustainable packaging, growers think only 13% of consumers will pay that much more.

Eco-friendly packaging was also the No. 1 product feature that helps consumers identify a product as sustainable, with 60% of consumers surveyed indicating so. When consumers were asked what they are personally doing to pursue a sustainable lifestyle, choosing products in eco-friendly packaging was No. 1, with 44% indicating that’s one way they live a sustainable lifestyle.

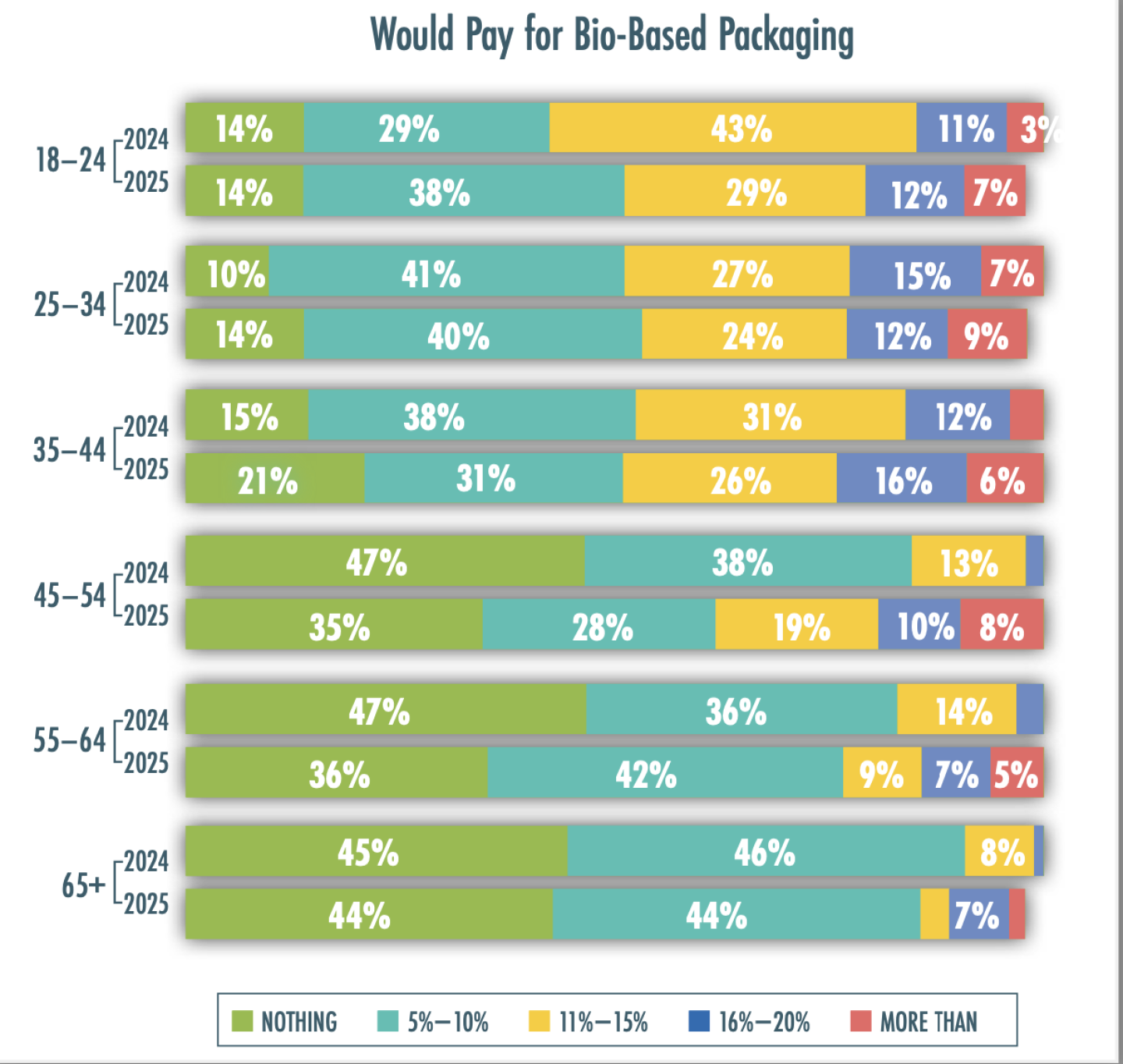

When it comes to the type of sustainable packaging preferred, the survey found that consumers have the greatest preference for bio-based packaging materials over recyclable, compostable or recycled packaging materials.

And they’re willing to pay more for it. The percentage of consumers indicating they are willing to pay upward of 15% more for bio-based packaging is up significantly from 10% in 2024 to 18% in 2025. While this is more prominent among age groups under 45 years old, even those aged 45 or older are showing more willingness to pay for bio-based packaging.

Sustainability Resonates With Younger Consumers Most

As with The Packer’s Fresh Trends 2025 report, Sustainability Insights 2025 reveals differentiators in fresh produce including sustainability, organic, environmentally friendly and more are resonating across generations — especially with younger consumers.

Sustainability Insights found that while 66% of consumers indicate sustainability is extremely or very important in their produce buying decisions, and 94% place some importance on sustainability, it is particularly important to those under age 45 and more so among those aged 18 to 24, 88% of whom indicated it was a priority in their produce purchase.

Clarke says it isn’t surprising that sustainability is resonating most with younger consumers and, as this group ages, sustainability will continue to gain importance with produce shoppers.

“Sustainability as a topic is something that has been part of day-to-day life for younger generations,” he says. “A hyperconnected world, social media, news at an instant and the expansion of mobile video as a method of communication has increased awareness of environmental causes among younger consumers.”

“They are active consumers, but [they] also want to be responsible consumers, and one way they can participate is in their purchasing choices,” he continues. “And as the young consumers move up into older age groups, they will carry that increased importance of sustainability with them.”

What sustainability terms resonate most with today’s shoppers? Sustainability Insights 2025 finds that eco-friendly, organic, regenerative farming, local and transparency of the product journey, are the leading product features consumers associate with sustainability.

Food Waste is Top Concern

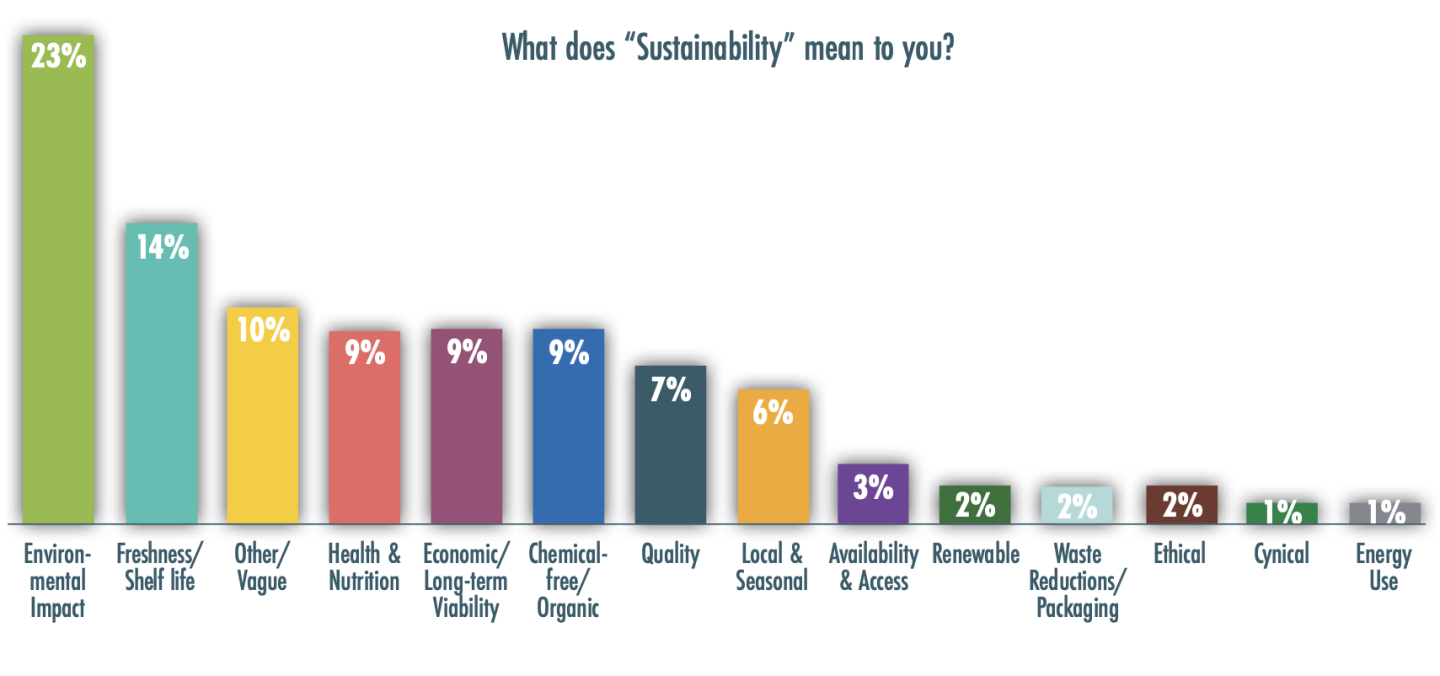

Surveyed consumers said they view sustainability as many things, including: environment, freshness, health/nutrition, economic viability, organic, local, renewable, availability, waste reduction and energy use. However, food waste was the top reported concern associated with a sustainable food supply, followed by a desire to improve human health, and climate change.

When asked how important a brand’s commitment to reducing food waste is to their fresh produce purchase, consumers placed the highest importance on this effort, with 71% of consumers saying reducing food waste was extremely or very important.

“I think there are two key factors at play driving food waste concern,” Clarke says. “The first is awareness and consciousness about waste continues to increase. Younger generations have grown up with recycling and waste awareness as part of their culture. There was no shift in habits that had to take place like it did with older generations. Awareness is inherent in younger populations.”

“The second key factor is food cost and inflation and the significant impact it has had on budgets over the past two to three years,” he adds. “When you pay more for the food in your home you don’t want to see any of it go to waste, so consumers are being more conscious of what and how much food they buy and how to make best use of it.”

Consumers surveyed in Sustainability Insights 2025 also indicated they are increasingly changing their purchasing habits in favor of sustainability and taking additional actions to reduce waste compared to the 2024 survey’s results.

Forty-four percent said they choose eco-friendly packaging (recyclable, biodegradable, etc.); 41% said they are acting to avoid disposable plastic products; about one-third or 37% of consumers indicated they purchase from brands that seek to reduce food waste; 65% of consumers said they try to recycle both at home and away from home; 48% said they try to buy food with recyclable packaging and 36% said they buy food in bulk to avoid too much packaging.

Younger Consumers Eye Climate Change

Sustainability Insights 2025 found that younger age groups place more importance on addressing climate change, with 76% of those aged 18 to 24 saying this effort is extremely or very important; 66% of those aged 25 to 34; and 58% of those aged 35 to 44 indicate this is a priority. That declines with older age groups, as 53% of those aged 45 to 54 and 44% of those aged 65 or older said addressing climate change is important.

With younger generations more concerned about climate change and supporting brands that address it, suppliers and retailers would do well to communicate their efforts.

“Climate change has largely become one of the most prominent reasons for sustainability efforts,” Clarke says. “When we asked consumers where they look for sustainability information, they indicated that product packaging was most important followed by grower websites. This ran true across all age generations.”

“When we looked at Gen Z and younger millennials specifically, social media, news media and in-store signage all clustered together following product packaging and grower websites,” Clarke continues. “Grocery retailer’s website ranked lowest as an information source among younger consumers.”

Investing in Locally Grown, Organic

When Sustainability Insights asked consumers to indicate the sustainability practices they were most willing to pay more for, local topped the list.

“Locally grown is the sustainability practice consumers are most willing to pay more for, with 83% of consumers saying they will pay more for locally grown produce,” Clarke says. “Younger millennials echoed this sentiment, with 92% saying locally grown is the sustainability practice they are most willing to pay more for. Among

Gen Z sentiment shifts a little, with 92% saying they would be most willing to pay more for organic produce, followed by 87% of Gen Z’s saying they would pay more for locally grown.”

While favored by younger shoppers, locally grown produce resonates across all demographics, ranking first or second across all age groups as the sustainability practice for which consumers are most willing to pay more.

Sustainable Opportunities

With many consumer respondents to the Sustainability Insights 2025 survey having said they are increasingly changing purchases and habits in favor of sustainability, how can produce suppliers and retailers better appeal to sustainability-minded consumers?

“Consumers tell us that choosing eco-friendly packaging is the top action they personally take to pursue a sustainable lifestyle,” Clarke explains. “Consumers consider bio-based, recyclable, compostable and recycled materials

as all being sustainable packaging, but they now rank bio-based as their top choice for sustainable packaging.

“More use of bio-based packaging and communications around its use will be well accepted by consumers and most beneficial to the fresh produce industry,” he adds. “Additionally, consumers are looking for more locally grown and organic produce from their grocery stores. Retailers would be well advised to place more emphasis on promoting locally grown and organic products in their stores.”

Consumers indicated they are willing to pay more for food grown via sustainable practices: 83% said they will pay more for locally grown, 80% will pay more for regenerative farming or for organic, 77% will pay more for climate smart and 76% said they will pay more for non-GMO or fair trade certified.

Source: https://www.thepacker.com/